Excellent private market data for successful fundraising

We are providing unparalleled services to fund managers navigating the private markets with unwavering support. Our platform, a unique private placement investment tool, is meticulously designed to support fund managers in establishing and growing their funds with ease. advinda stands out from other investor data providers by offering a comprehensive solution that combines private market data with a CRM tool, all at a single, competitive price. Our clients can access continuously freshly researched data, tailored to their specific fundraising needs.

How can I set up a successful fundraising strategy?

Fill in the gaps in your investor landscape and streamline your

fundraising efforts. We have organized global investor intelligence data into 50+

packages, categorized by

- Investor types

- Asset allocation

- And regions

Where do you have your white spots in terms of investor base?

Getting Investor Mapping for Free!

Getting Investor Mapping for Free!We offer free investment mapping advice, leveraging the expertise of our fundraising professionals at DC Placement Advisors.

We are a team with extensive expertise in providing fundraising advice. Let our experts guide you in selecting the optimal investment mapping and packages, saving your time, and eliminating the need to spend excessive energy on decision-making for a successful fundraising campaign.

Which investor has allocation to my fund?

We provide you with the precise investor insights you need to gain fundraising success. Institutional investors have a clear investment strategy and asset allocation. advinda has done the research and is publishing the asset allocation of institutional investors on an annual base. Today, we have become one of the leading institutional investor databases globally.

advinda clients can map investors by asset class and know if the investor has allocation for their fund.

In which region of the world shall I raise my fund?

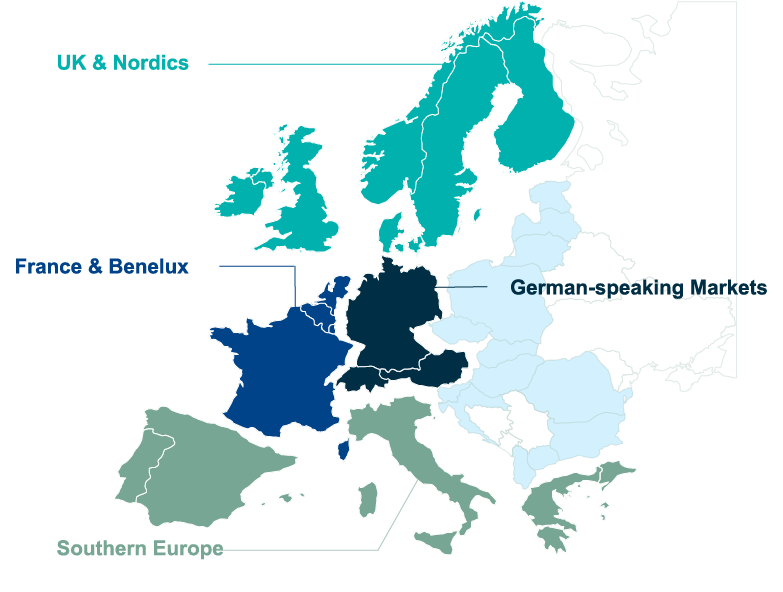

Our market intelligence is geographically focused on Western-Europe with its main areas of institutional investing

- Nordics

- Benelux

- DACH

- Italy/Spain/Portugal

- France

- UK

Being complete as a global provider we have added top investors of

- North America

- Asia

- Middle East

- Australia

Which investor type is interested in my fund?

Institutional investors require an excellent track record. What can I do if I am a first-time fund or a sector focused or regional focused fund?

We have a segmentation based on investment types such as

- pension fund

- insurance companies

- investment consultants

- family offices (biggest in the market)

- asset managers

- private banks

- sovereign wealth funds

- fund of fund managers

- German saving banks (hard to find it in other platforms)

and others.

Is a top 10 investor the right investor for my fund or who else could invest?

Our network spans over 30,000 investment decision-makers, collectively overseen by 8,000+ LPs managing a staggering EUR 100+ trillion in Assets Under Management (AuM) globally.

advinda is providing European investor intelligence of investors with a minimum threshold of EUR 1 billion and can go up to the biggest investors in Europe with AUM of EUR 2.6 trillion.

advinda clients can cluster their investor list by AUM per investor.

Big investors getting bombarded by fund managers every day. Sometimes and for many funds with smaller or midranges fund size it makes sense to target also mid-sized investors in the range of EUR 10 bn AUM to EUR 25 bn.

Choose advinda for a seamless bridge to building connections and advancing your ventures in the private markets—because advinda is about empowering you to build and thrive

What can I get for my money?

You pay only what you need for your successful fundraising.

Our professional investor mapping will guarantee to speak to the right investors.

You choose those who are the right investors in terms of

- Geographic region

- Type of investors

- Size of investors

Each investor profile in our CRM includes contact details for the decision maker and the latest information on asset allocation. This entails Asset under Management, investment focus, preferred region of investment, etc. including a graphical representation of the asset allocation summary.

At the core of advinda is a comprehensive solution that consolidates all fundraising activities into a single, user-friendly interface. This includes managing essential aspects such as investor asset allocation,

Our CRM can help to establish and follow a professional fundraising process

For those who have not yet implemented an own CRM ystem inhouse, we have developed a basic CRM system which can be used to implement and operate in a professional manner. It is free for advinda clients who buy at least one package.

You can follow the process, send out emails to investors and log your activities in the system and create fundraising dashboard.