EU NAVIGATOR

Navigating the new AIFM pre-marketing rules

From August 2nd 2021, pre-marketing rules have changed: No longer, fund managers are allowed to test the appetite of investors without alerting the regulators

Private capital managers face additional regulatory hurdles in their investor communications.

Before, fund managers could check the appetite of institutional investors for their strategy without notifying the regulator.

From 2nd August 2021, under the new rules, alternative investment fund managers (AIFM) must send a letter to inform the local regulator within two weeks of starting the pre-marketing. The letter should state where the pre-marketing will take place and for how long. It should also include a description of the pre-marketing activities and details of the funds being pre-marketed. For 18 months after an AIFM has started pre-marketing, any new subscription from an investor will be considered the result of marketing, and the AIFM will need to notify the relevant regulator.

Nina Dohr-Pawlowitz, Managing Director and Head of Placement, says:

Reverse solicitation is no longer possible. Fund managers are already in pre-marketing when they are seeking reverse solicitation from investors.

Pre-marketing must be carried out by a Markets in Financial Instruments Directive (MiFID) firm; an Undertakings for Collective Investment in Transferable Securities (UCITS) management company; or a tied agent.

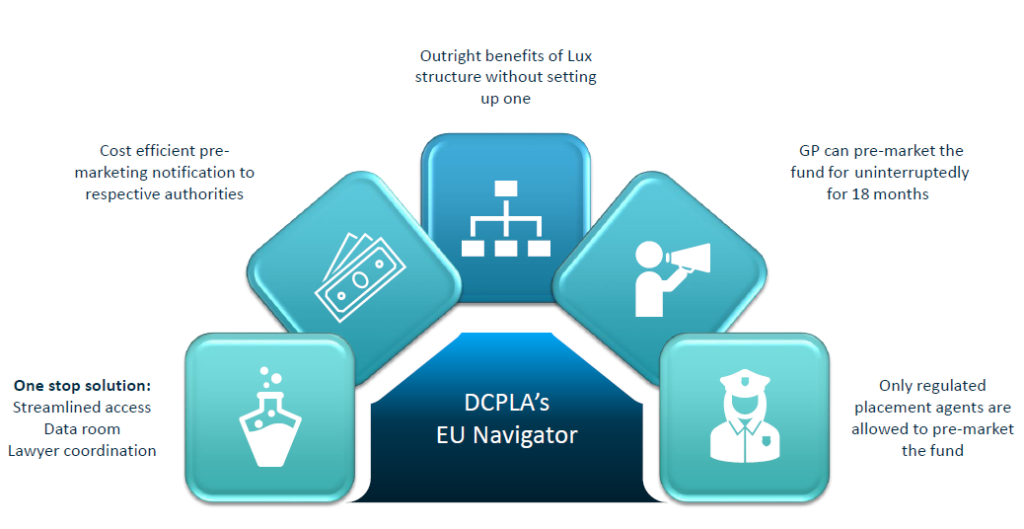

Benefits from Our Corporation with DC Placement Advisors”

EU Navigator: DCPLA’s unique, simplified solution for the pre-marketing hurdles